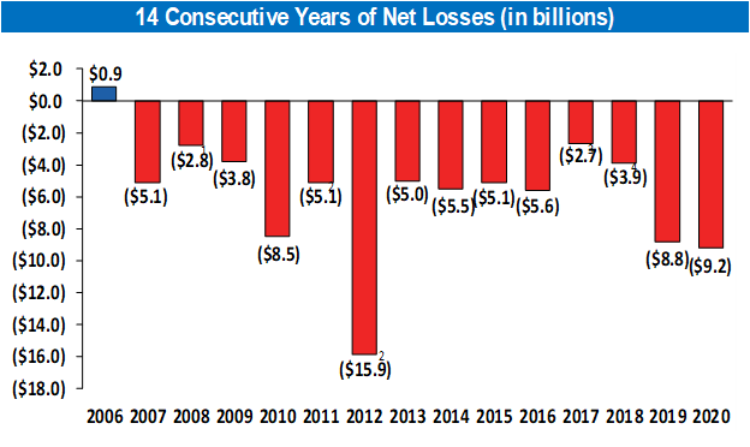

The U.S. Postal Service (USPS) has faced significant inefficiencies and financial losses over the past decade, a situation that can be attributed to several intertwined factors:

Declining Mail Volume:

Shift to Digital Communication: The most significant contributor to USPS’s financial woes has been the drastic decline in traditional mail volume, particularly First-Class Mail. Over the past decade, with the rise of email, social media, and digital payment systems, the number of letters sent has plummeted. For instance, first-class mail volume fell to its lowest level since 1968 in 2023, highlighting a long-term trend that has only accelerated with each passing year.

Impact of Economic Recessions: Economic downturns, like the Great Recession of 2007-2009, further exacerbated these declines as businesses cut back on marketing and individuals reduced expenditures on mail services.

Cost Structures and Inefficiencies:

Fixed Costs: USPS operates with a high proportion of fixed costs, including labor, pensions, and retiree health benefits. These costs do not decrease proportionally with declining mail volumes, leading to inefficiencies. Over 80% of the net loss in 2024 was attributed to factors outside of management’s control, like pension liabilities and non-cash workers’ compensation adjustments.

Operational Inefficiencies: The service has been criticized for its operational inefficiencies, including outdated infrastructure, excess facilities, and high labor costs. Despite attempts to modernize operations, the scale of the USPS network, designed for a much higher volume of mail, remains largely unchanged, leading to underutilized resources.

Legislative and Regulatory Challenges:

Pre-funding Mandates: The Postal Accountability and Enhancement Act of 2006 required the USPS to pre-fund retiree health benefits for future retirees, an obligation not typically seen in private sector businesses. This mandate alone has contributed significantly to the financial losses, with billions of dollars being set aside each year, even if these funds were not immediately needed.

Limited Pricing Flexibility: Until recent legislative changes, USPS had limited ability to adjust prices to match inflation or operational costs, further straining its finances. Although now there’s more flexibility with two annual rate changes, this has not been enough to offset the overall decline in revenue.

Revenue Diversification Challenges:

Package Delivery: While there has been some growth in package delivery, particularly during the e-commerce boom, this has not been sufficient to offset losses from traditional mail. The USPS has struggled to capture significant market share from private competitors like FedEx and UPS, who can offer more specialized services.

Service Expansion: Attempts to diversify into new services have been met with mixed success, with some arguing that these ventures are not core to the USPS’s mission, potentially diluting focus and resources.

Inflation and Economic Factors:

Inflationary Pressures: Over the last few years, inflation has increased operational costs, particularly in areas like fuel, transportation, and employee compensation, without a corresponding increase in revenue from postal services.

COVID-19 Impact: The pandemic initially surged package volumes but also led to significant operational disruptions, increased costs, and further declines in traditional mail due to quarantine measures and economic shutdowns.

Modernization Efforts and Their Limitations:

Delivering for America Plan: Postmaster General Louis DeJoy’s 10-year plan aims at modernization and financial recovery, but progress has been slower than anticipated. While some cost reductions have been achieved, the plan’s success in fully reversing financial losses remains uncertain, with ongoing debates about its effectiveness and implementation.

In summary, the USPS’s inefficiencies and financial losses over the past decade are a complex mix of external market shifts, internal cost structures, legislative constraints, and challenges in adapting to a rapidly changing postal landscape. While various strategies have been employed to mitigate these issues, the deep-rooted structural and economic challenges continue to pose significant hurdles to financial sustainability.

And then there’s THIS GUY…

Here we are, folks, in the land of the free, where the U.S. Postmaster General, Louis DeJoy, is the second-highest-paid federal employee, raking in a cool annual salary of $305,681 (not including those sweet, sweet bonuses and perks). Now, you might ask, “What does this guy do to earn that kind of cash?” Well, let me enlighten you: he’s managed to steer the U.S. Postal Service into a net loss of a whopping $9.5 billion. That’s right, with a “B” for “Brilliant financial strategy.”

Why does Louis DeJoy still have a job, you ask? It’s a mystery wrapped in an enigma, served with a side of incompetence. Here we have an organization that’s been bleeding red ink for years, and yet, our man DeJoy, the maestro of money-losing, continues to lead with the finesse of a bull in a china shop. His strategy? Watch the profits vanish like a magician’s trick, but instead of pulling rabbits out of hats, he’s pulling billions out of our pockets.

Is it because he’s the best at losing money? Or maybe they’re keeping him around for the sheer spectacle of watching someone fail upwards. Imagine if your job performance was judged by how much red you could paint the financial statements. If that were the case, DeJoy would be Employee of the Century!

So, let’s raise our glasses to Louis DeJoy, the financial wizard who has turned the USPS into the world’s most expensive paperweight. Here’s to hoping that one day, someone in Washington decides that maybe, just maybe, a salary like his should come with the expectation of, oh, I don’t know, making the postal service not lose billions. Until then, enjoy your snail mail arriving slower than a glacier moves, all while paying for the privilege of such stellar leadership. Bravo, DeJoy, bravo.